Nvidia, the graphics processing behemoth, has astounded analysts by surpassing its quarterly revenue forecast, capitalizing on the surge in artificial intelligence (AI) demand propelling its cutting-edge chip sales. The company’s announcement of a colossal $25 billion stock repurchase has further elevated its stock value, with share prices soaring after the market’s closure on Wednesday.

The revenue projection for the quarter has left industry experts in awe, as the forecast of Nvidia exceeded expectations by a significant margin, underscoring the ongoing momentum of generative AI technologies. These technologies, heavily reliant on Nvidia’s chips, continue to gain traction without signs of slowing down.

In a strategic move, Nvidia has unveiled a $25 billion stock repurchase plan, coinciding with a year where its shares have tripled in value. This surge in market capitalization has propelled Nvidia to a historic milestone, making it the first trillion-dollar chip company. This remarkable growth reinforces investors’ conviction in Nvidia’s potential to be a dominant player in the burgeoning AI market.

The industry buzz highlights that demand for Nvidia’s prized AI chips currently outpaces supply by around 50%. This supply-demand gap is anticipated to persist for several quarters, emphasizing Nvidia’s unassailable position within the market.

Jensen Huang, Nvidia’s CEO, commented, “Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI.”

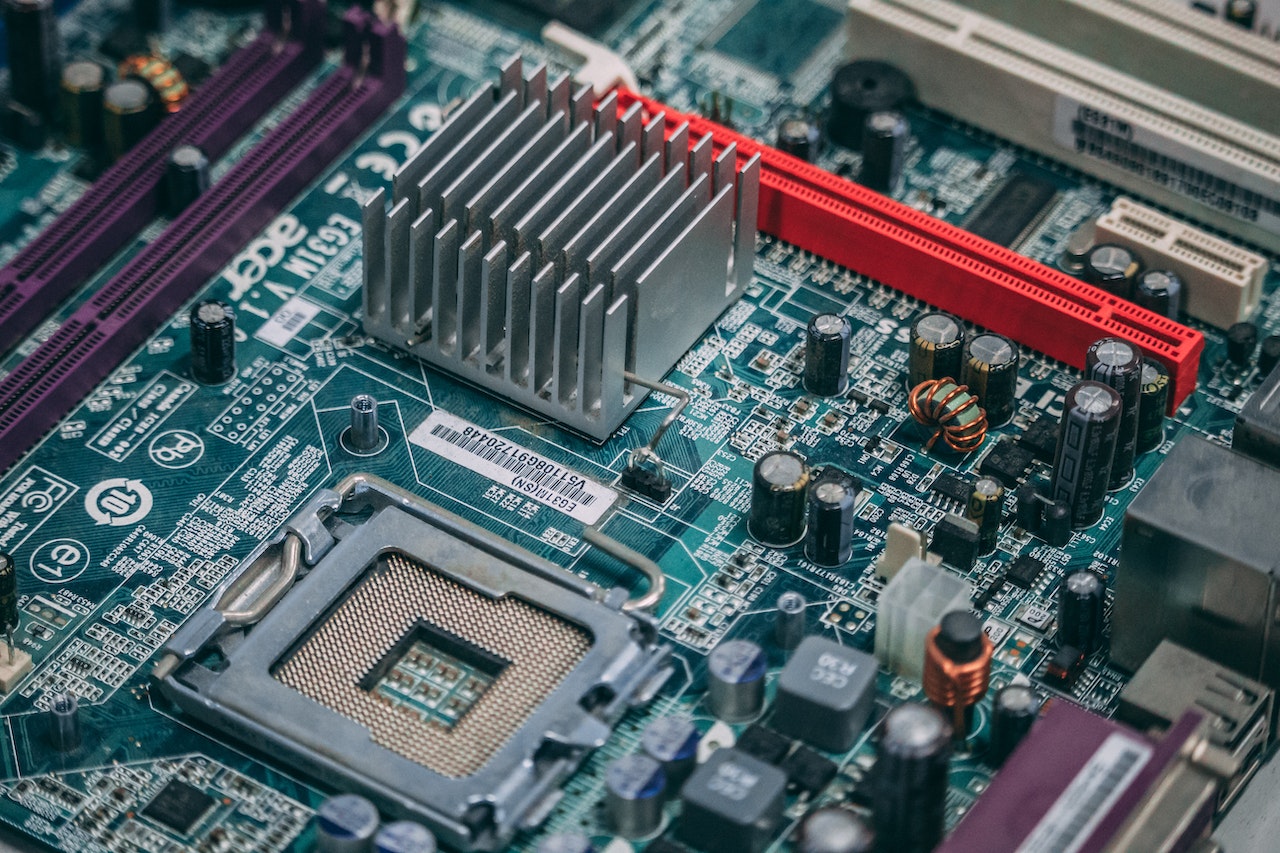

Following the announcement, Nvidia’s shares experienced an impressive 9.6% surge during after-hours trading, achieving an unprecedented all-time high. Notably, Nvidia’s robust growth in the quarter wasn’t solely driven by chip sales, but rather by the holistic success of its AI systems. These systems encompass complete machines that incorporate memory chips from various suppliers, along with an array of meticulously integrated components.

The ripple effect of Nvidia’s positive report was evident as it triggered gains in the shares of other tech giants and AI-focused companies. Microsoft witnessed a 1.9% rise, while Meta Platforms and Palantir Technologies recorded gains of 2.1% and 4.6% respectively during extended trading.

Daniel Ives, a prominent analyst from Wedbush Securities, aptly described the results as a “‘drop the mic’ moment” that could potentially reshape the tech landscape for the remainder of the year.

As the demand for Nvidia chips intensifies across AI startups and major cloud service providers such as Microsoft, China’s insatiable appetite for these chips remains a driving force. Chinese companies are rushing to secure chip orders before potential future U.S. export restrictions are enforced.

Addressing the potential repercussions of export controls, Nvidia’s CFO Colette Kress assured analysts that such constraints would not have an immediate impact on the company’s results. However, she cautioned that these controls could impede the U.S. industry’s capacity to lead and compete in the expansive global market.

The forecast of Nvidia for the upcoming quarter projects revenue of approximately $16 billion, with a slight variance of 2%. In contrast, analysts surveyed by Refinitiv had projected an average of $12.61 billion.

During the second quarter, the company’s adjusted revenue stood at $13.51 billion, surpassing estimates of $11.22 billion. Particularly noteworthy was Nvidia’s data center business, which witnessed a staggering 141% surge in revenue to $10.32 billion by the end of July 30th. This figure exceeded analyst predictions by over $2 billion, as per Refinitiv data.

Jacob Bourne, senior analyst at Insider Intelligence, remarked, “Its Q2 results underscore its dominant position in harnessing the AI momentum.”

Amid the promising trajectory, Nvidia faces the challenge of navigating complex supply chain dynamics to enhance production. The company’s commitment to securing supply resulted in a notable 53% increase in inventory commitments from the previous quarter, largely driven by the sustained demand for data center chips.

While rivals like Advanced Micro Devices may chip away at Nvidia’s market share with competing AI chips, Nvidia’s software continues to maintain a substantial lead, a factor analysts consider advantageous in the long run.

The AI sector’s growth trend is expected to persist, gradually overshadowing traditional server equipment expenditure and further bolstering Nvidia’s position.

In the gaming segment, Nvidia’s revenue soared to $2.49 billion, exceeding analyst estimates of $2.4 billion, according to Refinitiv data.

Excluding extraordinary items, Nvidia’s second-quarter earnings per share amounted to $2.70, surpassing estimates of $2.09 according to Refinitiv data.

For the forthcoming third quarter, Nvidia anticipates an adjusted gross margin of 72.5%, with a slight potential variation of 50 basis points. In contrast, analysts’ average forecast places the gross margin at 70.4%, as per Refinitiv data.

Source: Reuters