Friday’s trading session unfolded against the backdrop of Intel’s somber outlook, sending shockwaves through the tech sector and triggering a retreat in stocks. The S&P 500 (^GSPC) tiptoed just below the break-even point, grappling with the aftermath of Intel’s lackluster first-quarter projections that fell significantly short of Wall Street’s expectations.

Thursday had marked a triumphant surge, with the benchmark notching another record high. Yet, the Dow Jones Industrial Average (^DJI) remained virtually unchanged, showcasing the tug-of-war within the market. Meanwhile, the Nasdaq Composite (^IXIC) bore the brunt of the downturn, recording a 0.2% dip as technology stocks took a hit.

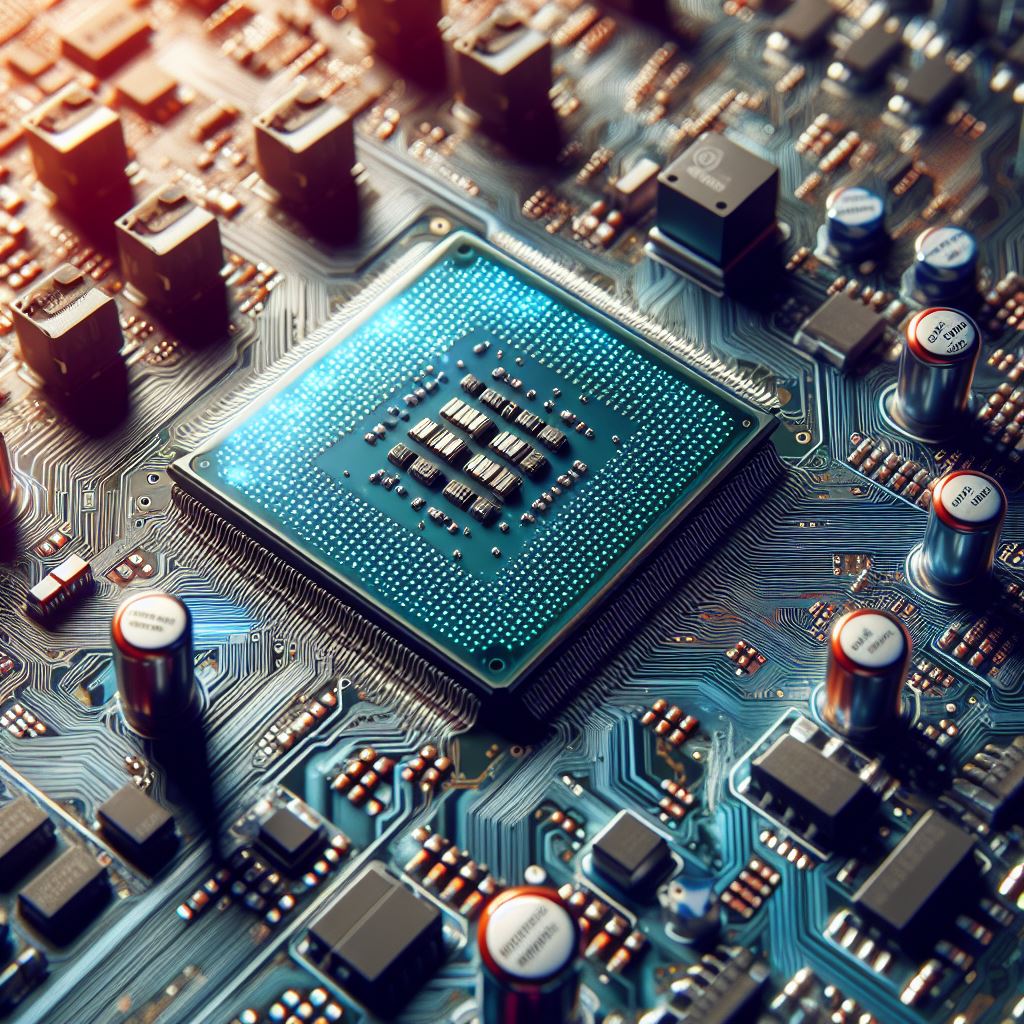

Intel’s unsettling outlook, which saw its shares plummeting over 10% in premarket trading, cast a shadow over the optimistic narrative fueled by artificial intelligence advancements. Industry counterparts AMD (AMD) and Nvidia (NVDA) also experienced a modest dip, underscoring the ripple effect of Intel’s downbeat forecast.

However, the market found solace in the release of the Personal Consumption Expenditures (PCE) index for December, a crucial gauge of inflation and a touchstone for the Federal Reserve. The “core” PCE, the central bank’s favored inflation measure, exhibited a downward trend, falling below 3% on an annual basis—its slowest pace of growth since March 2021.

This inflationary respite, coupled with an unexpectedly robust early estimate of fourth-quarter US GDP, is kindling the belief among investors that the US economy is navigating towards a “soft landing.” As central bankers gear up for their inaugural policy meeting of the year next week, the prevailing expectation is for them to maintain interest rates at their current levels. However, the recent string of encouraging economic indicators could nudge them towards a potential rate cut later in the year, with March looming as a plausible starting point.

Meanwhile, the investor community remains vigilant, eagerly awaiting the next wave of corporate earnings reports for insights into the pulse of Corporate America and the broader economy. Colgate-Palmolive (CL) and American Express (AXP) took center stage on Friday, with heightened attention on the latter following a lukewarm revenue-growth forecast from payment card rival Visa (V).

As the market grapples with the aftermath of Intel’s somber outlook, investors find themselves on edge, navigating a landscape of uncertainty and volatility in the days ahead.

Source: Yahoo Finance