Stocks surged at the opening of the trading week, buoyed by robust performances in the tech sector, which propelled major indices higher, except for the Dow Jones Industrial Average (^DJI) that faced headwinds due to a substantial sell-off in Boeing (BA) shares. The S&P 500 (^GSPC) experienced a notable uptick of approximately 1.4%, while the Nasdaq (^IXIC), dominated by tech stocks, recorded an impressive 2.2% surge. Simultaneously, the Dow managed to eke out a modest 0.6% gain. This positive momentum comes after the major stock indexes concluded a nine-week winning streak on the previous Friday.

Monday marked a notable milestone, witnessing the best single-day gains for both the Nasdaq and the S&P 500 since November 14. However, the joyous market atmosphere was marred by the plummeting Boeing shares, which witnessed an 8% decline. The nosedive followed the grounding of some 737 Max 9 jets by US authorities due to a midair fuselage blowout. This incident also adversely impacted Spirit AeroSystems (SPR), the fuselage maker, with shares plunging more than 10%.

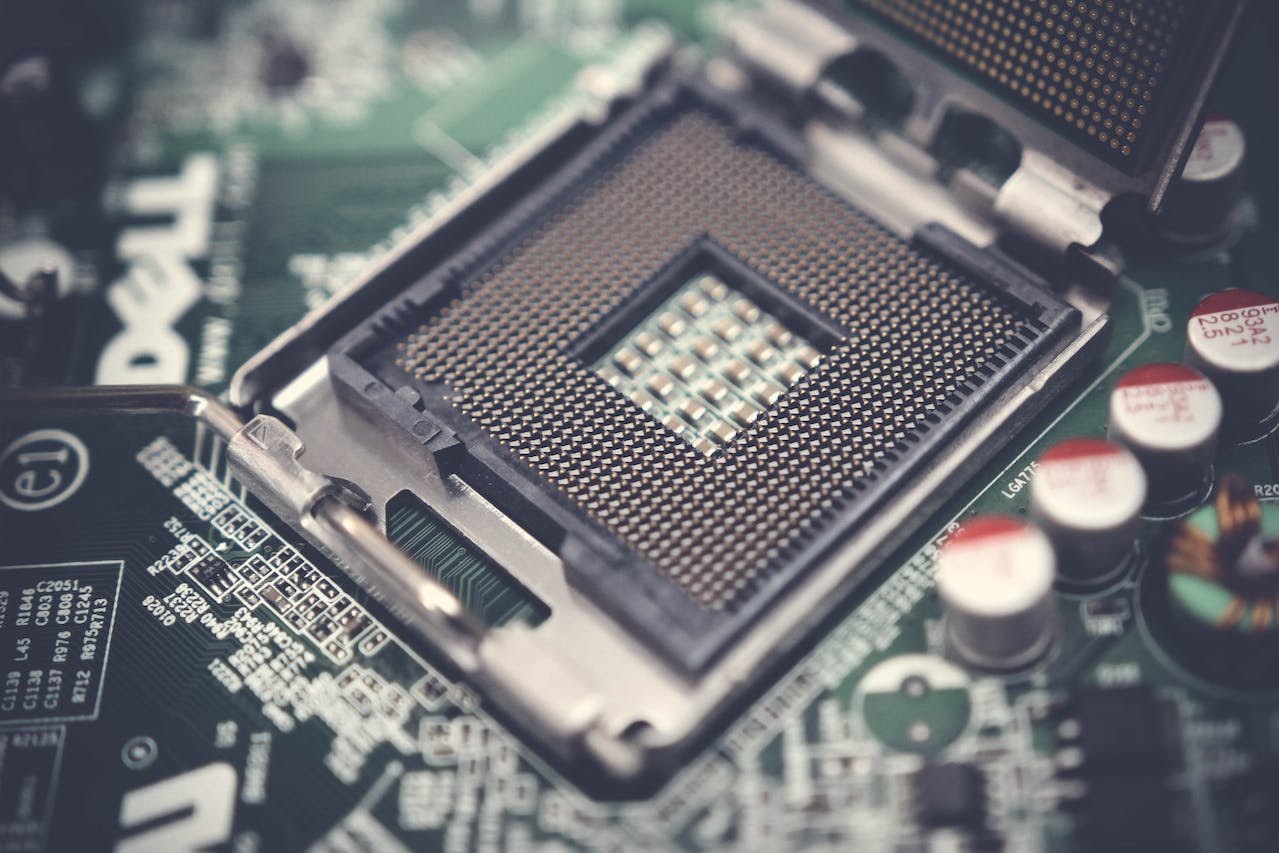

Conversely, Nvidia (NVDA) experienced a surge of over 6% on the back of reports suggesting the semiconductor giant’s plans to launch a China-focused AI chip in the second quarter of 2024. The cryptocurrency market also saw heightened activity, with Bitcoin (BTC-USD) surpassing $47,000 for the first time since April 2022. Excitement surrounding the potential approval of an ETF for the world’s largest digital currency contributed to the positive sentiment.

As the trading week unfolds, market participants are eyeing potential catalysts, including earnings reports from major banks and a crucial inflation reading. The Consumer Price Index (CPI) inflation reading is scheduled for release on Thursday, with JPMorgan (JPM), Wells Fargo (WFC), and Bank of America (BAC) kickstarting the fourth-quarter earnings season.

Meanwhile, oil prices experienced a nearly 4% decline as investors reacted to Saudi Arabia’s decision to cut key prices of crude supplies across all regions, including its main Asia market. This move had a significant impact on the energy sector, influencing market dynamics during the trading session.

In conclusion, the start of the trading week witnessed a robust performance in the stock market, with tech sector stocks leading the charge. However, challenges in the form of Boeing’s share sell-off and fluctuations in the oil market added a layer of complexity to the market landscape. Investors remain vigilant as the week progresses, anticipating key events such as earnings reports and inflation data that could shape the market’s trajectory in the coming days.

Source: Yahoo Finance