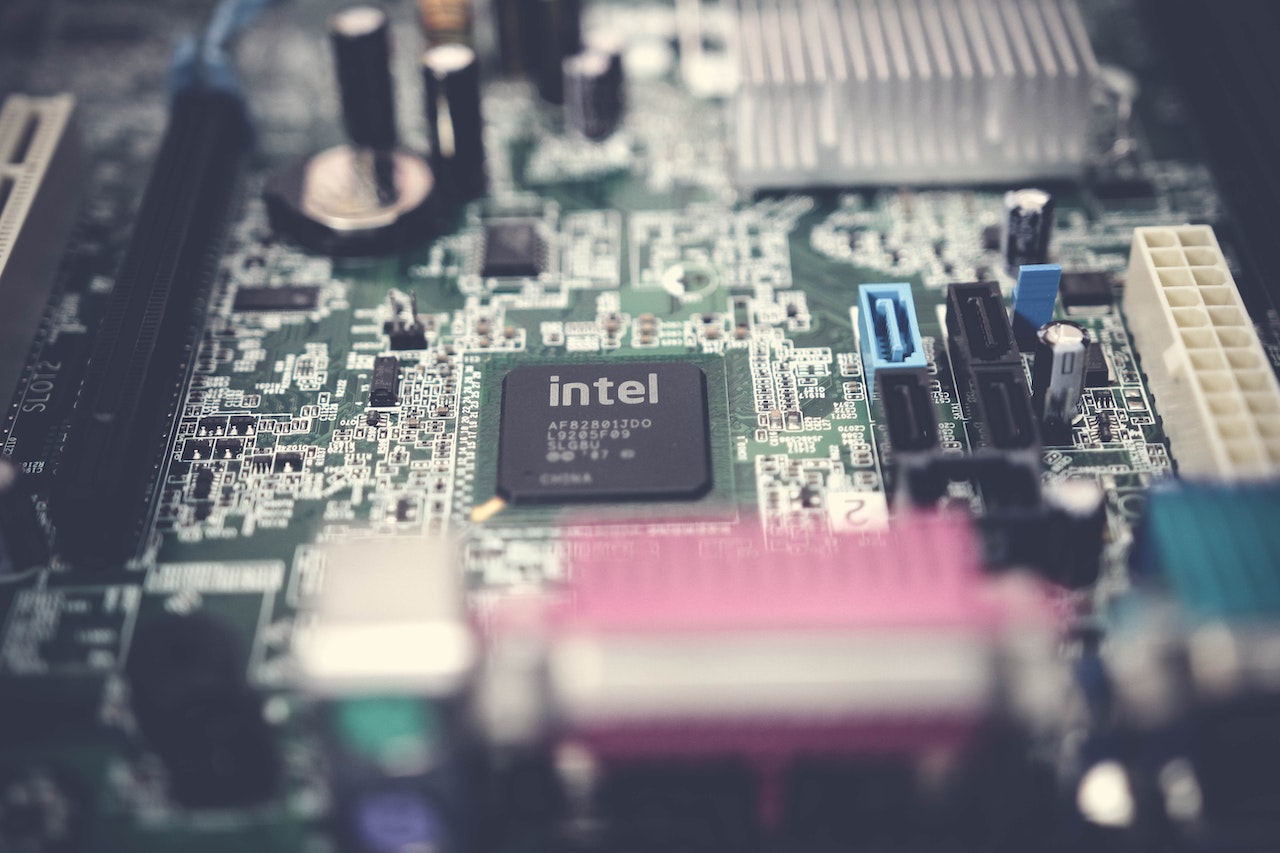

In the dynamic landscape of the second quarter’s technology rally, hedge funds made a notable dash to catch up, but one tech giant found itself shunned: Intel Corporation. Renowned firms, including Steven Cohen’s Point72 Asset Management LP and David Tepper’s Appaloosa Management LP, led the charge in reducing their stakes in Intel. The exodus from the chipmaker was pronounced, with the quantity of Intel shares jettisoned by these hedge funds surpassed only by those of mobile device manufacturer Nokia Oyj. This collective shift in investor sentiment, underscored by these sell-offs, has cast a shadow over Intel’s prospects, revealing a potential crisis of confidence.

Jim Awad, senior managing director at Clearstead Advisors, dissected the situation, emphasizing, “If everyone is selling a stock, that says something.” Awad contended that Intel’s allure as a tech investment pales in comparison to other viable options within the industry. The gravity of the situation is compounded by Intel’s termination of its $5.4 billion bid to acquire Tower Semiconductor Ltd. This abortive deal was perceived as a linchpin in CEO Pat Gelsinger’s strategy to infiltrate the dominant foundry market, currently lorded over by Taiwan Semiconductor Manufacturing Co.

Despite these setbacks, Intel did unveil glimmers of progress last month, surprising the market with a profit for the second quarter and pledging further strides in the latter half of the year. A tepid 3.2% uptick in its stock this quarter places Intel as the third-strongest performer in the Philadelphia Semiconductor Index. Yet, this modest gain is overshadowed by the ascendancy of other chip manufacturers. As the industry evolves, investors are exploring alternate avenues, echoing Awad’s sentiment that Intel’s rejuvenation could be a protracted endeavor.

The hedge funds’ collective lack of confidence in Intel is emblematic of the early phases of the company’s turnaround initiative. Its repercussions have the potential to reverberate through the company’s future trajectory. This growing skepticism underscores a broader theme in the technology sector, reflecting investors’ proclivity for diversification. Notably, technology stocks have experienced a cooling trend in August, with the Nasdaq 100 Index veering closer to the year’s nadir and testing its 50-day moving average.

Beyond the Intel saga, other notable developments punctuate the tech landscape. Tesla Inc. came under scrutiny as it initiated a second round of price cuts in China, eliciting concerns of a resurgent price war. Simultaneously, Apple Inc. commenced iPhone 15 production in Tamil Nadu, signaling a concerted effort to bridge the operational gap between Indian and Chinese markets. Tencent Holdings Ltd. reported revenues that markedly missed expectations, attributing the shortfall to escalating Chinese economic uncertainty and subdued consumer sentiment. The significant 29% downturn of Sea Ltd. has fueled conjecture regarding the future prospects of this e-commerce and gaming leader.

Looking ahead, a cascade of earnings reports is set to be unleashed, featuring prominent names like JD.com, OneConnect, Cisco Systems, Synopsys, Wolfspeed, and Avnet. Concurrently, Brookfield has entered the insurance sphere, aligning with the broader trend of private equity firms diversifying their investment portfolios.

Regionally, housing cost concerns have taken center stage, particularly in Nassau County, New York, and Florida. In the face of rising interest rates, private equity firms have exhibited reluctance to relinquish their holdings, spotlighting the intricate interplay between housing markets and financial strategies.

In the midst of the second quarter’s technology upsurge, the consensus of the hedge funds to jettison Intel Corporation’s shares underscores a burgeoning doubt in the chipmaker’s resurgence. Consequently, alternate tech stocks like Tesla Inc., Apple Inc., and Tencent Holdings Ltd. stand to gain from the redirection of investor capital. As earning reports loom on the horizon, Intel remains a work in progress compared to its chip-making peers. The repercussions of the preceding quarter’s developments could indelibly shape the latter half of the year, potentially molding the trajectory of the tech sector as a whole.

Source: Bloomberg